2023

From insight to impact: Understanding Financial Wellbeing

Managing money is emotional, complex, and deeply personal. Every individual carries a unique relationship with their finances, shaped by hopes, challenges, and previous experiences.

As part of my work at Nordea, I led the design and execution of a customer research initiative to gain a deeper understanding of these dynamics. Building healthier financial relationships starts with truly listening.

To reduce money-related stress and empower people in their financial lives, I spearheaded the creation of a comprehensive customer study, designed to uncover real needs, real struggles, and real opportunities for impact. From defining the research objectives to constructing the survey and synthesising insights, my role spanned across the whole process, ensuring the results would directly support strategic decision-making.

Background & purpose

Financial well-being is a strategic priority for Nordea. However, to address it meaningfully, we first needed to deepen our understanding of how customers experience financial stress, financial health, and financial confidence in their everyday lives.

The survey was constructed using established Financial Wellbeing theory and Nordea's internal strategic needs. We used the Consumer Financial Protection Bureau (CFPB) Financial Health Scale to segment respondents by financial health level, as well as Nordea’s internal lifestage segmentation, enabling a structured analysis and basis for deep insights.

The goals were

Understand how customers perceive financial well-being.

Identify customer needs, motivations, and barriers.

How do social and economic contexts and life stages influence these factors.

What needs and wants (JTBD) do people have in terms of improving their sense of financial wellbeing?

Three lenses

We designed the survey so enable a multi-layered analytical model:

Full Population Analysis: Identifying overarching patterns across all participants.

Financial Health Segmentation: Analysing key differences across different financial health levels.

Life Stage Segmentation: Exploring how financial wellbeing perceptions shift across life stages (young adults, mid-life, retirement).

To ensure the accuracy of our insights, each participant’s Financial Health (FH) score was manually calculated based on the CFPB five-question framework. Participants were then segmented both by their financial health level and by life stage. This hands-on approach allowed us to cross-analyze patterns in financial wellbeing across different financial situations and life stages, forming a strong foundation for strategic decision-making.

Key findings and insights

Most participants defined financial well-being as the absence of financial worries, the ability to make life-enhancing choices, and achieving financial independence. However, the meaning of what constitutes financial well-being varies depending on financial health levels.

Financial situation vs. perception

A poor financial situation, especially during early life stages (e.g., studying), did not necessarily correlate with low financial well-being. Participants who trusted in their financial management skills and future earning potential often still reported high financial well-being.

Different Factors, Same Goal

While the broad definition of financial well-being was similar across groups, the building blocks that constituted it differed.

Participants with lower health scores associated well-being with the ability to manage monthly expenses and avoid debt.

Higher health score participants associated it with wealth growth, future security, and lifestyle freedom.

Confidence is key

Financial confidence, not just actual income, strongly influenced perceived well-being. Participants with high confidence in managing money reported significantly less financial stress, even with modest incomes.

Financial stress is ubiquitous, but outcomes differ

80% of all participants experienced financial stress, but those with higher financial health were significantly more capable of resolving stressful situations, often through better planning and financial buffers.

Financial planning

People’s day-to-day financial behaviours, like budgeting, saving, and investing, had a stronger link to their financial health than their age or income level. This suggests that good financial habits and mindset can be even more crucial for well-being than the amount of money one earns or the stage of life they are in. Suggesting that by helping customers to learn and adopt good money habits, there is an opportunity to influence their financial well-being without direct changes to their incomes.

Support needs are linked to financial standing

Lower health score groups prioritised basic needs: help with saving, monthly budgeting, and debt management.

Higher health score groups looked for advanced support: wealth management, investment optimisation, and retirement planning.

Trust in Digital Tools

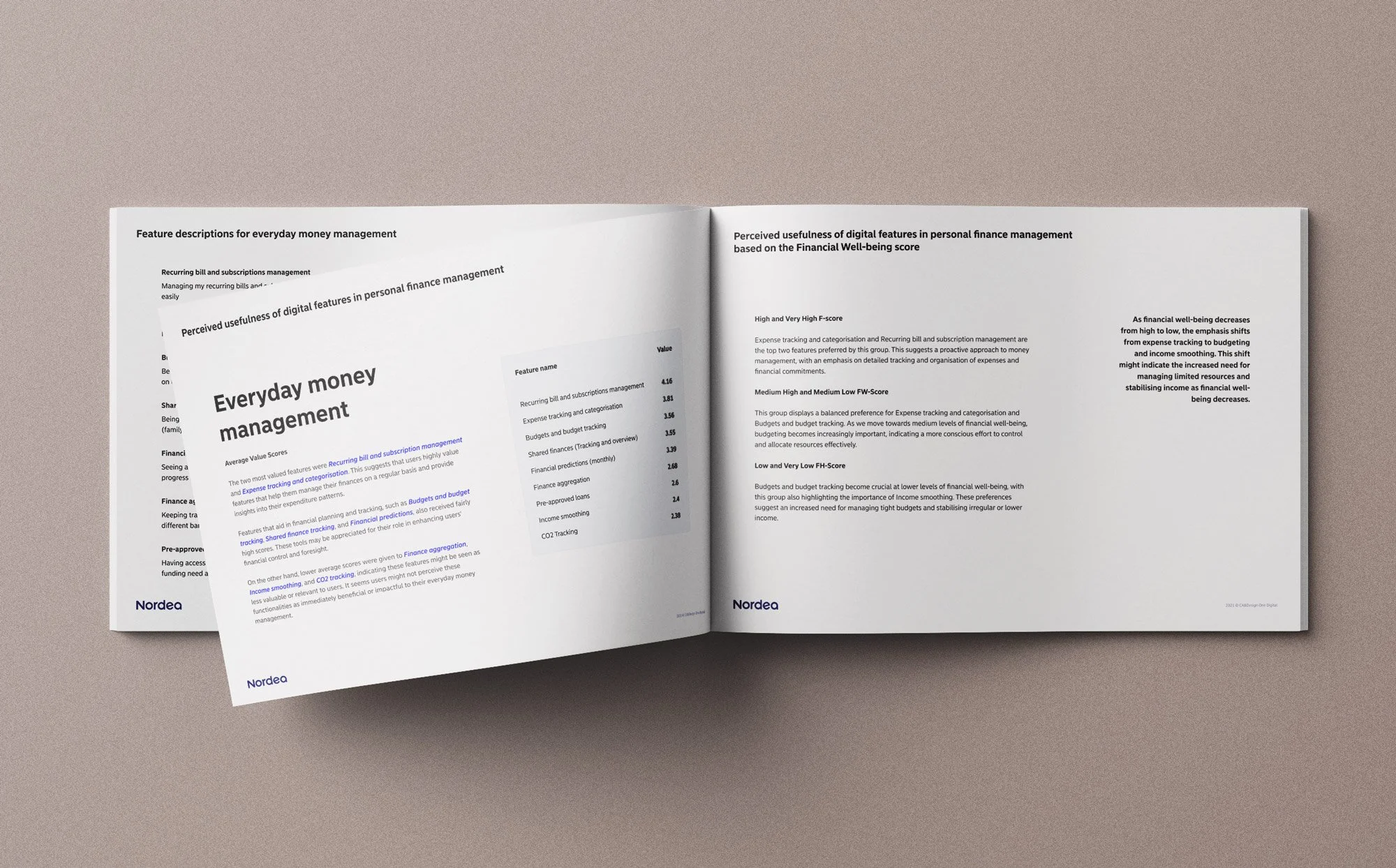

Participants across all health levels valued digital tools that offered automation and simplicity, but the demand for comprehensive financial overviews and investment tracking increased with higher financial health levels.

Customers want simple, automated, and holistic digital tools, not just for expense tracking, but for building long-term resilience. Access to personalised financial advice is highly valued, particularly around more complex financial topics like investments, savings, and retirement planning.

Financial well-being is strongly influenced by having financial security and preparedness, stable and sufficient income, good expense and debt management, good health and personal relationships, and confidence in one’s ability to manage finances independently.

Participants with lower financial health scores valued basic personal finance tools to manage day-to-day needs. Participants with higher financial health scores placed more value on tools that provided a complete overview of their financial situation, including net worth tracking and investment performance monitoring, emphasising a desire for long-term growth and strategic financial management.

The results show a clear correlation between financial well-being and confidence in making sound financial decisions. As well-being increases, so too does confidence in financial decision-making.

Strategic Outcomes

The results from the study provided a rich, validated foundation to

Prioritise features in the digital financial wellbeing roadmap.

Segment services and communications based on both life stage and financial health level.

Develop more personalised, proactive financial guidance and digital interventions.

Strengthen strategic investments in automation and simplicity in everyday money management tools.